Estate planning is a legal process that defines how an individual’s estate, or all the assets they own, is managed and distributed to their loved ones and inheritors after their passing. There is this misconception that estate planning is exclusive to the wealthy when, in fact, it is something that everyone can and should do. Setting your assets in place while you remain in control of your finances is key to ensuring that the people you love will be cared for. Moreover, once you have established your estate plan, it is much easier to change it along the way.

Neglecting to prioritise estate planning or succession planning could disrupt your family harmony, jeopardise the business you have worked so hard on, and face many other pitfalls, resulting in outcomes that may not align with your wishes.

Strategic estate planning

There are various ways to achieve your desired outcomes with strategic estate planning based on your unique financial situation, family dynamics, and long-term goals;

1. Business succession planning

If you own a business, consider how it will continue to operate after your departure. A well-structured business succession plan ensures a smooth transition of ownership and management, preserving the value of your business for your heirs. Succession planning in this context involves identifying and developing the future leaders of your company so that business operations continue to run smoothly and not take a turn for the worse should the unexpected happen.

2. Trusts for asset protection

While most people generally think of writing a will when they want to get started with their estate planning, trusts are another alternative worth considering. Trusts are powerful tools that enable you to manage and protect your assets while providing for your beneficiaries. Trusts also offer several other advantages, such as flexibility in wealth distribution and tax planning.

Unlike wills that only go into effect after an individual’s death and dictate who receives their estate, trusts can take effect as soon as they are signed and allow one to transfer their assets while still alive. Trusts are commonly used when leaving assets to children under 21 years old, making them particularly useful for protecting family assets that might otherwise go to beneficiaries who are financially immature or vulnerable, spendthrifts, or too young to get substantial inheritances.

There are two types of trusts in Singapore:

- Revocable living trust allows you to retain control of your assets during your lifetime while designating beneficiaries. It can bypass probate, ensuring a faster distribution process.

-

Irrevocable trusts offer stronger asset protection. Assets placed in an irrevocable trust are generally shielded from creditors and potential legal disputes.

3. Minimising tax implications

Estate taxes can significantly impact the wealth you pass on to your beneficiaries. Although Singapore does not impose estate or inheritance taxes on persons who passed away on or after 15 Feb 2008, other taxes like capital gains tax on certain assets may still apply. Moreover, it is important to note that estate duty can still be levied on property or investments overseas. Thankfully, there are many ways to mitigate tax implications, such as:

- Life insurance as a financial safety net: Consider gifting assets during your lifetime to reduce the value of your estate subject to taxation. It would be best to consult a tax professional to ensure compliance with Singapore’s tax laws.

-

Insurance planning: Life insurance policies can provide liquidity to cover estate taxes or other financial obligations upon your passing.

Life insurance as a financial safety net

It is becoming increasingly important to protect against whatever unexpected curveball life throws our way. This is where life insurance in Singapore, such as China Taiping’s Infinite Elite Legacy (USD), comes in for your estate planning.

With a guaranteed benefit of up to 3.5 times the basic sum assured until age 86, Infinite Elite Legacy (USD) assures surrender value upon policy inception, and even with preferential premium rate rewards for good health, Infinite Elite Legacy (USD) is an all-in-one plan that can assist you for estate planning as well as business continuity. The death benefit acts as a financial safety net to support loved ones such as settling financial liabilities like mortgage and saves the family from liquidating certain assets to support their livelihood.

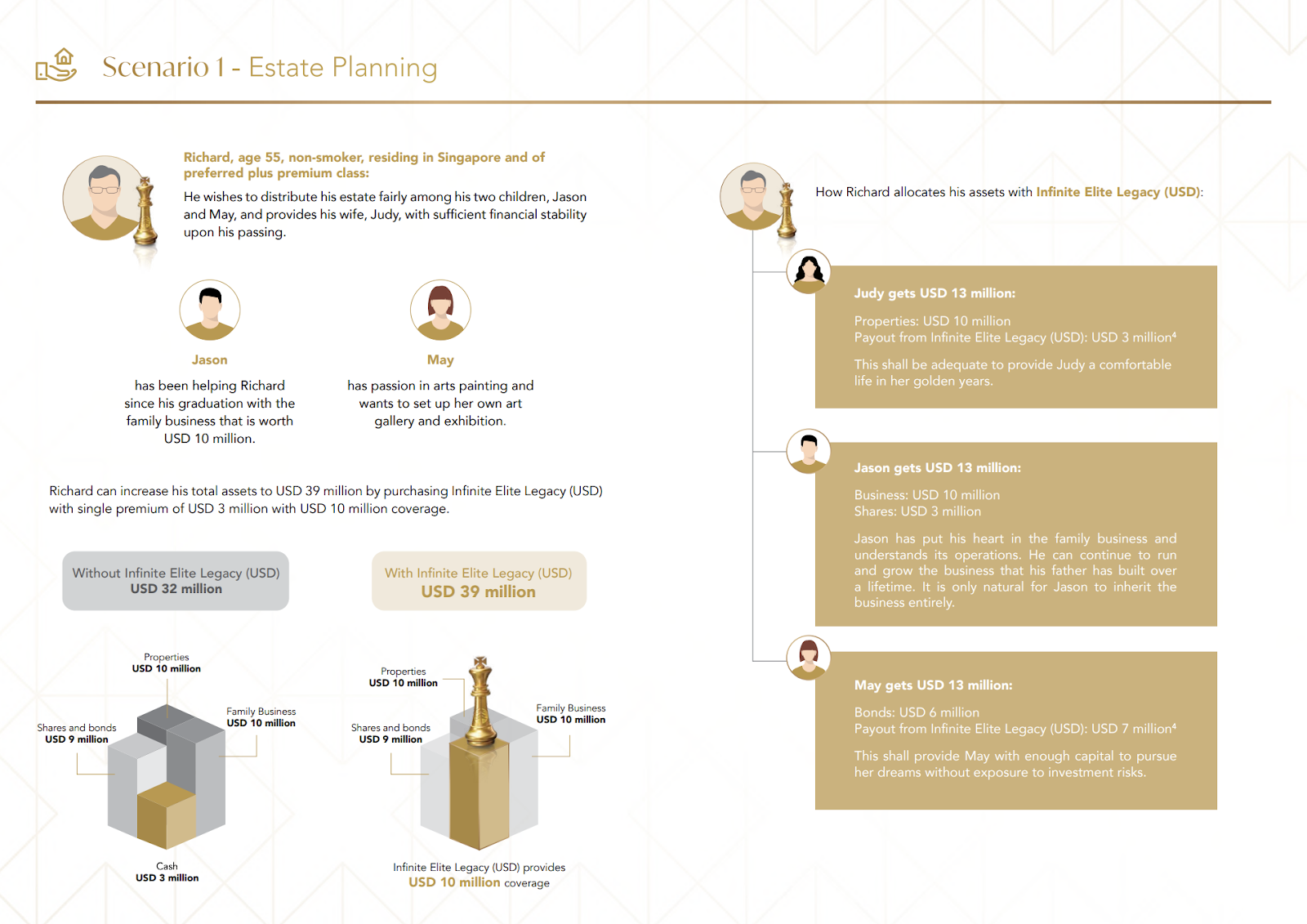

Take Richard’s situation, for example. Based on the scenario above, Richard can increase his total assets to USD 39 million by purchasing Infinite Elite Legacy (USD) with a single premium of USD 3 million for USD 10 million coverage.

This is an example of using life insurance to distribute wealth and ensure financial stability for loved ones upon his passing. By carefully structuring his estate plan, Richard can provide his wife, Judy, with sufficient financial support to maintain her lifestyle, while also ensuring that his children, Jason and May, receive inheritances tailored to their individual interests and needs. This strategic approach to estate planning not only safeguards Richard's legacy but also fosters financial security and opportunities for his family members in the future.

Conclusion

By employing strategic tools and approaches, you, too, can navigate the complexities of wealth preservation, guaranteeing a seamless distribution of assets. This proactive approach not only provides peace of mind for the present but also safeguards the financial well-being of future generations.

To learn more about estate planning, speak to your preferred Financial Adviser Representative today.

Download PDF