In the event of any accident involving the motor vehicle, irrespective of whether it would give rise to a claim or not, the driver shall report the accident to any of our listed Accident Reporting Centres with his/her accident vehicle for photo taking within 24 hours or by the next working day, regardless if there is any visible damage, and irrespective of whether you are claiming from any insurers or third parties. Failure to report within 24 hours of the accident may affect your NCD upon renewal.

Please do not allow your vehicle to be taken away to any other workshops and do not sign any agreement given by any unauthorised tow-truck operator.

Click here to view our panel workshops for towing service.

| Procedures |

What to do during a motor accidentMake sure everyone is safe and stay calm. Exchange ParticularsPlease take note of the following:

** Police report need to be lodge first under the following circumstances:

|

|||||||||||

| Accident Reporting Centres |

Our policyholders are required to lodge the motor accident report within 24 hours of the accident or by the next working day with their accident vehicle (before any repair), even if there is no damage, and irrespective of whether you are claiming from any party or not, at the following centers:

* Vehicle must be present at the time of e-filing Following the motor accident reporting, you would also be required to decide, within 14 days, if you would be claiming under your own policy or against the third party. (Please note that you will only be able to claim under your policy if your coverage is Comprehensive) |

|||||||||||

| Accident in Malaysia |

Stay Calm, Safety First.Please take note of the following:

Please report the accident to the local authorities within 24 hours. In the event the vehicle can no longer be driven, please contact our Authorised workshop for towing services. You may contact us at +65 6389 6116 (Claims Department) for assistance during office hours (9am – 5pm). When you return to Singapore, please proceed with the following procedures for accident reporting: - If the accident involves a Malaysia registered vehicle in Malaysia, please report the accident at our Accident Reporting Centres in person (refer to “Accident Reporting Centres”, for accident report procedure), bringing along a copy of the Police Report lodged in Malaysia and other relevant documents from the local authorities (if available). |

|||||||||||

| At the Workshop |

If you are claiming under your policy (Own Damage (OD) Claim:)(For Comprehensive Coverage Only) Depending on the terms of the policy, you may choose to bring your vehicle either to the Distributor or our Authorised Workshop. For AutoSafe Plan, it is compulsory that the vehicle be sent to our Authorised Workshop for repairs and the Excess may be applicable. The Distributor or Authorised Workshop will handle the claim by submitting a preliminary estimate of the repairs to our office. Following an inspection by our surveyor (on a case by case basis), we shall proceed to authorise the distributor/workshop to carry out repair works accordingly, subject to policy terms. If you are claiming against the insurer of the Third Party:You may appoint any workshop from our authorised list OR your preferred workshop to handle the claim on your behalf. Please note that should you choose this option, you will not be able to revert to your own insurance policy for indemnity (Please refer to General Condition 5 (b) of your Policy Jacket). ** In the event you receive a third party claim from the owner of the other vehicle(s) or his/their appointed representative, please contact us @ +65 6389 6116 or email us (This email address is being protected from spambots. You need JavaScript enabled to view it.) immediately with all attached documents upon receipt. |

|||||||||||

| Theft of Vehicle |

If your vehicle is stolen in Singapore, please lodge a police report immediately and bring the police report to our Reporting Centre to lodge the motor accident report immediately. You should notify your company/hire-purchase company (where applicable) as soon as reasonably possible. Similarly, if your vehicle is stolen in Malaysia, you are required to report to the local authorities in addition to the Singapore police report and follow the reporting procedures as per theft in Singapore above. Investigation would be conducted accordingly. |

|||||||||||

| Windscreen Damage |

In the event of a windscreen damage (provided there is no further damage to the Motor Vehicle), depending on the terms of your policy, you may choose to bring your vehicle to the Distributor (AutoExcel Plan), our Authorized Workshop (AutoSafe Plan) or Windscreen Workshop. An excess may be applicable. The distributor/workshop will handle the claim by submitting a preliminary estimate of the repairs to our office for assessment. We shall then proceed to authorise the distributor/workshop to carry out repair works accordingly. You may enquire about windscreen repair (instead of replacement) from our windscreen workshops. Where conditions are met, the waiting time is much shorter and excess can be waived. |

|||||||||||

| Frequently Asked Question |

1. If I do not intent to make any claim or my vehicle is not damage, do I still need to make the accident report? In the event of any accident involving the motor vehicle, irrespective of whether it would give rise to a claim or not, the driver shall report the accident to any of the Accident Reporting Centres with his/her accident vehicle (whether damaged or not) for photo taking within 24 hours or by the next working day, regardless if there is any visible damage, and irrespective of whether you are claiming from any insurer or third party. Failure to report within 24 hours of the accident may affect your NCD upon renewal. 2. What should I do if the accident happened outside of Singapore? If your vehicle is involved in an accident with another vehicle in Malaysia, please report the accident to the local authorities within 24 hours. In the event the vehicle can no longer be driven, please contact our Authorised Workshop for towing services. You may contact us at +65 6389 6116 (Claims Department) for assistance during office hours (9am – 5pm). When you return to Singapore, please proceed with the following procedures for accident reporting: - If the accident involves a Malaysia registered vehicle in Malaysia, please report the accident at our Accident Reporting Centres in person, bringing along a copy of the Police Report lodged in Malaysia and other relevant documents from the local authorities (if available). 3. What do I do when I received a letter from a third party lawyer related to the accident? In the event you receive a third party claim from the owner of the other vehicle(s) or his/their appointed representative, please contact us @ +65 6389 6116 or email us (This email address is being protected from spambots. You need JavaScript enabled to view it.) immediately with all attached documents upon receipt. Please do not reply to the third party lawyer or correspond with any third party pertaining to the accident. 4. What happen if I still decided not to make the accident report?

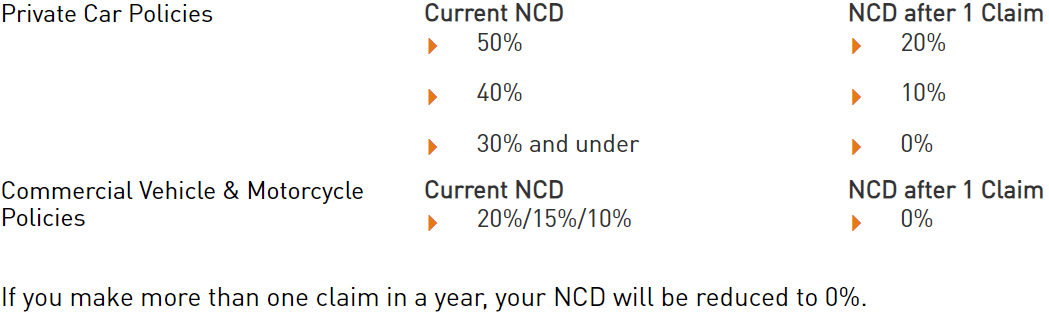

5. Will my No Claim Discount (NCD) be affected? Your NCD may not be affected if you are found not at fault in an accident involving another vehicle. In all other cases, your NCD may be affected. If there is a claim made under the policy,

You can read up more from the GIA- Motor Claim Framework (MCF). 6. Do I still need to report the accident if I had completed the Private Settlement/Memorandum of agreement with the involved parties? Yes. You will still need to lodge the accident report at our Authorised Reporting Centre as the agreement does not supersede the MCF process. A private settlement/Memorandum of agreement is a private matter between the two parties, but it would no change the requirement under MCF. You can read up more from the GIA- Motor Claim Framework (MCF). |

|||||||||||

| Disclaimer |

The above gives a brief and generalised summary of the claims procedure and is not an interpretation of the policy terms and conditions. We would advise that the policy schedule, endorsement, policy jacket and/or certificate of insurance should be read in conjunction with the above. Depending on the circumstances of each case, further investigations may be required and there may be a request for further documents. Assistance may also be sought from the policyholder/insured driver. |

|||||||||||